Latest News

Disease Focus

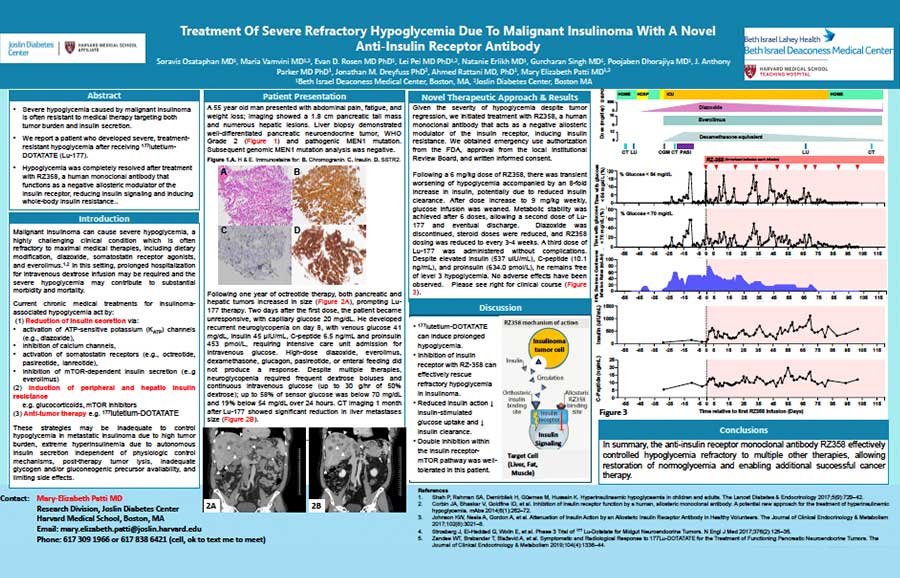

Congenital hyperinsulinism (HI) is a rare genetic disease that presents very early in life and is characterized by excess and erratic insulin secretion that can cause infants, children, and adults to become dangerously hypoglycemic and starve their bodies of glucose.

Diabetic Macular Edema (DME) is a disease associated with diabetes, when chronic excess glucose in the blood stream can cause inflammation and breakdown of the body’s blood vessels, including at the back of the eye where fluid may leak into the retina. DME is the leading cause of blindness in the US and elsewhere.

Tumor hyperinsulinism (HI) may be caused by two distinct types of tumors: islet cell tumors (ICTs) and non-islet cell tumors (NICTs), both of which lead to hypoglycemia due to excessive activation of the insulin receptor.

Our Story

At REZOLUTE, we are driven to develop novel therapies that boldly transform the treatment paradigm for debilitating diseases with significant unmet needs. We listen to the patient and the community to guide and inform our approach on bringing forward therapeutics that can make a difference. As parents, patients, and caregivers, the spectrum of our humanity informs and inspires everything we do in our mission to develop life-changing therapies. We are REZOLUTE in our commitment to restore balance to life.

Our Vision

A world where days are defined by special moments and balance is restored to the lives of patients and their families.